If you've been following the real estate market this year, you've probably noticed some shifting trends already. So what lies ahead for the rest of 2025? From home prices to mortgage rates, here’s what top housing experts are predicting and how those changes could affect your next move.

Many hopeful buyers are watching closely for a significant drop in home values. Headlines about slight declines in certain areas are fueling that belief—but the full picture tells a different story.

While home appreciation has cooled compared to recent years, there’s no indication we’re heading for a market crash. The National Association of Home Builders explains that home price growth is slowing because of rising inventory and softer demand. However, this easing is a natural correction—not a collapse.

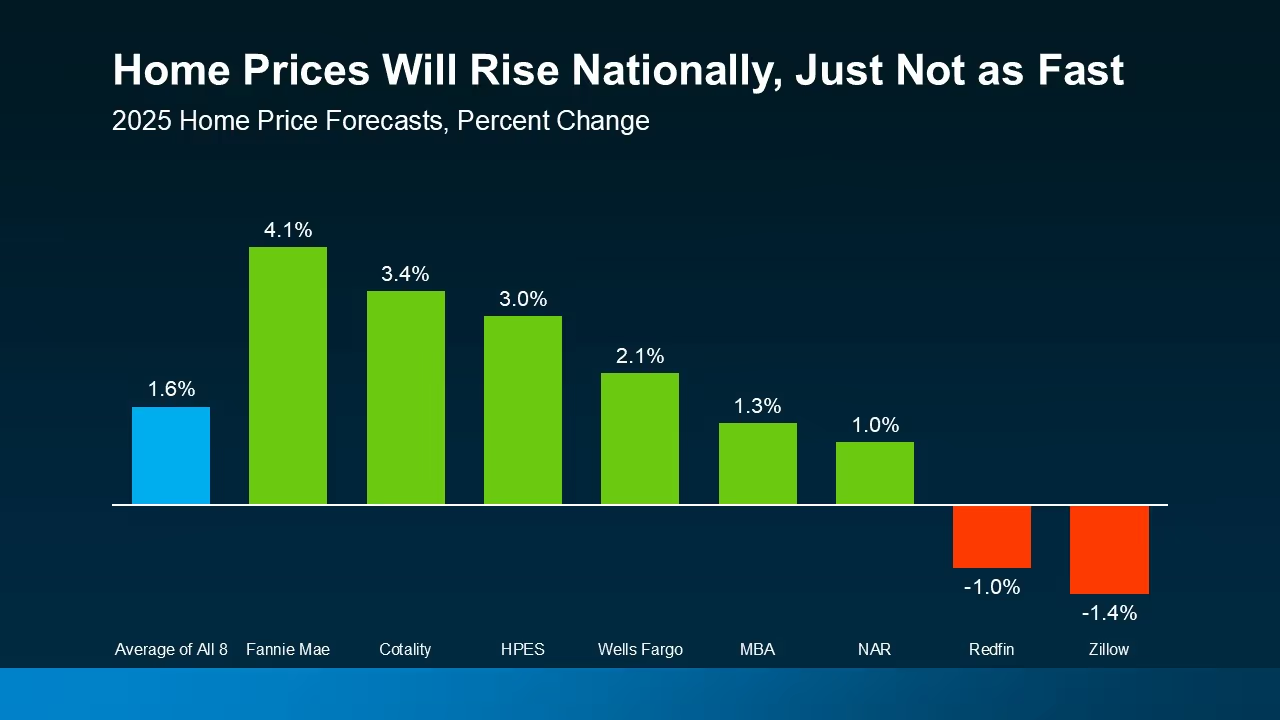

Industry experts forecast that home prices nationwide will still rise modestly in 2025, averaging around 1.5% to 2% growth based on projections from eight major sources.

Even in markets where slight price dips are happening, the changes are small—about -3.5% on average. That’s nowhere near the nearly 20% value loss seen during the housing crisis of 2008.

To put it in perspective: according to the Federal Housing Finance Agency, U.S. home prices have climbed over 55% in the last five years. So, while the pace is slowing, values are still heading upward in most areas.

The bottom line? Waiting for a price crash likely isn’t a winning strategy. Conditions will vary locally, so working with a real estate professional who knows your market is key to understanding what’s really happening near you.

Another common question right now is whether mortgage rates will fall significantly in the second half of the year.

The short answer: not likely.

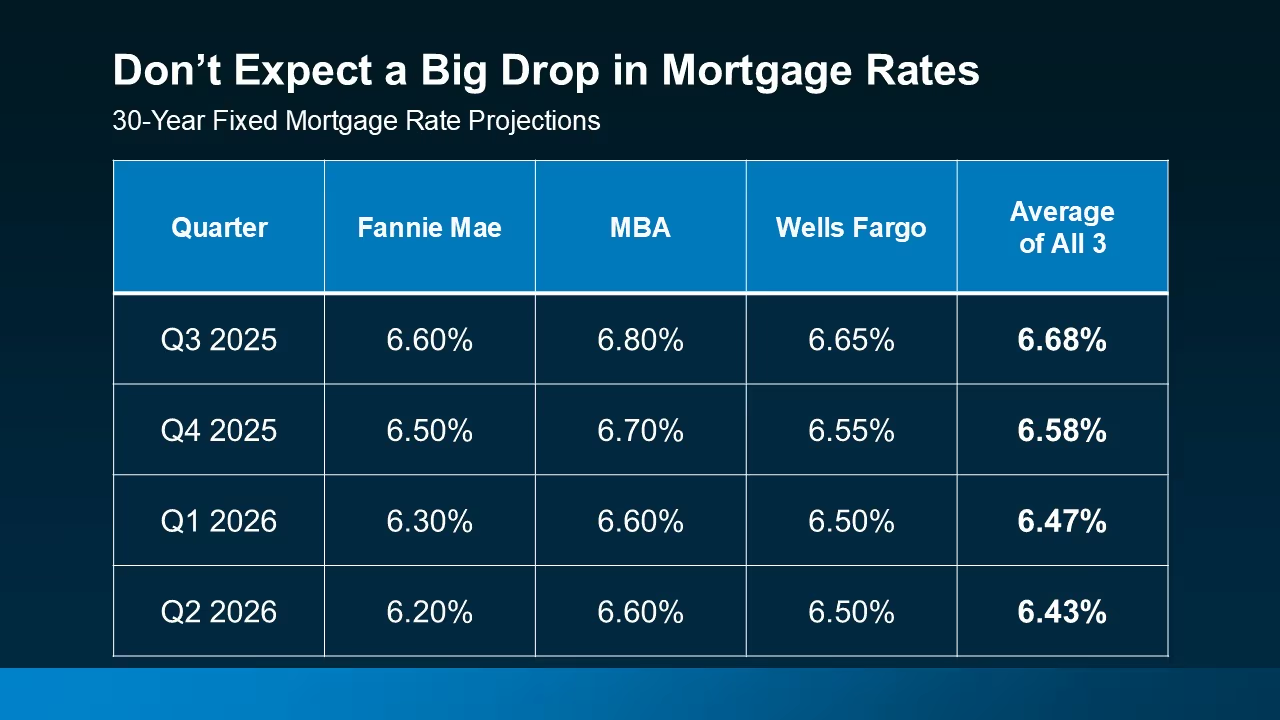

Yahoo Finance reports that the Federal Reserve and current economic data point to mortgage rates remaining steady—close to where they are today. Projections from multiple financial institutions suggest rates will average in the mid-6% range by the end of 2025.

This means rates may fluctuate slightly, but we’re not expected to see a dramatic drop any time soon. If you’ve been putting off your plans waiting for lower rates, you could end up missing opportunities that exist in today’s market.

Rather than trying to predict when rates might change, it’s smarter to evaluate what you can afford now and consider how a purchase would fit your financial goals. Locking in a rate today still allows for future refinancing if rates improve down the line.

Whether you're looking to buy, sell, or both this year, the real estate landscape is stabilizing—not spiraling. Price growth is moderating, and mortgage rates are expected to stay consistent for the foreseeable future. That means it’s time to approach your move with clarity, not hesitation.

This is a market that rewards preparation, planning, and perspective. By focusing on your needs instead of the noise, you can make smart, confident decisions—especially with the right guidance.

You don’t need to wait for perfect conditions to make a great move. The key is working with a local real estate expert who understands today’s market dynamics and how they impact your timing, pricing, and strategy.

Let’s connect and build a plan that aligns with your goals—whether you're looking to buy, sell, or explore both in 2025.