Buying a home should be exciting — not overwhelming. But if the thought of saving for a down payment has you feeling stuck, you’re not alone.

Let’s clear up the confusion. Most people believe they need a massive amount of cash upfront to buy a home. But the truth? That’s often not the case — and knowing the facts might move you from dreaming to doing sooner than you think.

Let’s break down some of the most common myths.

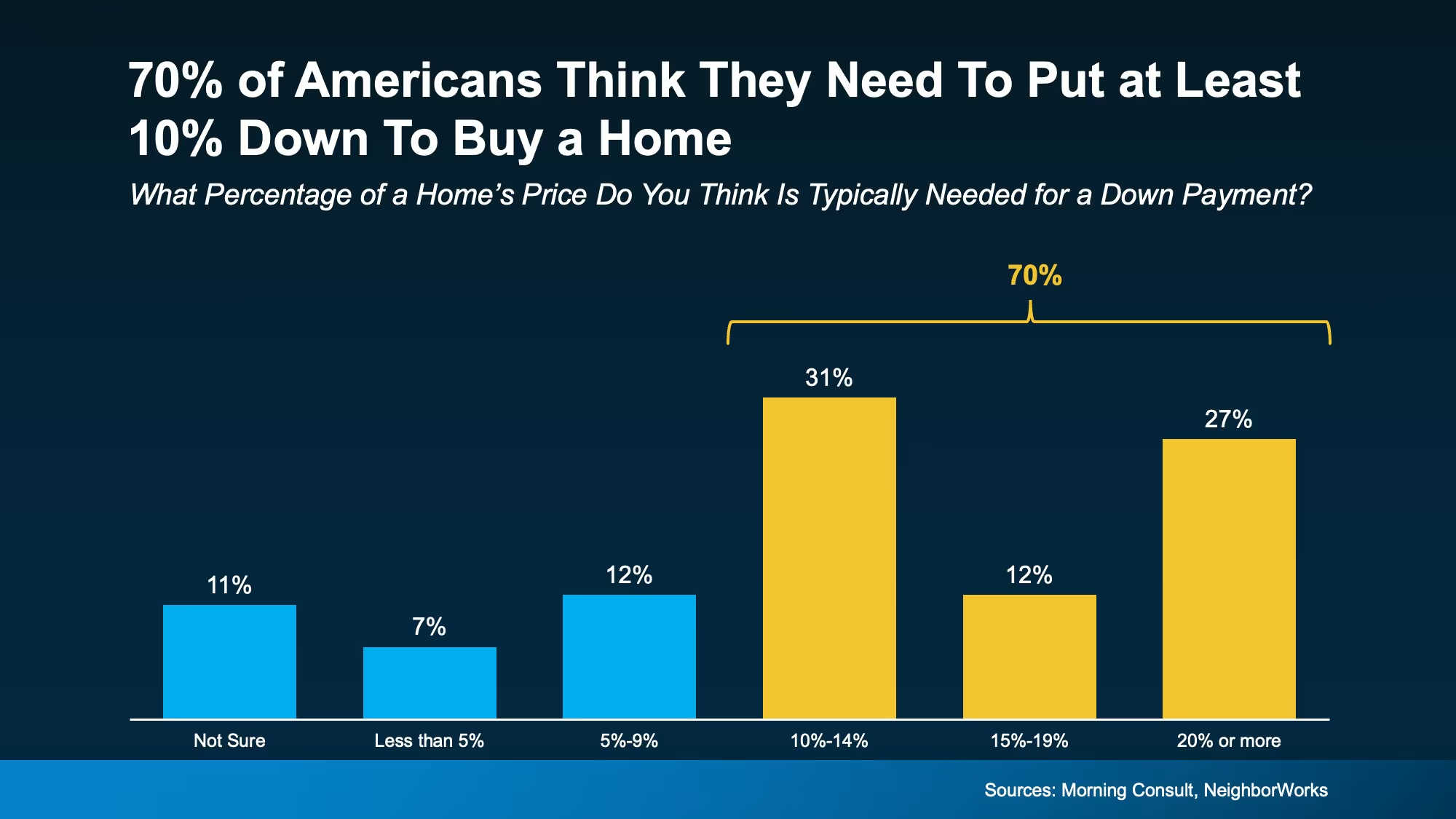

Many first-time buyers believe they need to put down at least 10%. In fact, a recent survey by Morning Consult and NeighborWorks found that 70% of Americans think 10% or more is required — and 11% weren’t even sure what’s expected.

But the data says otherwise. According to the National Association of Realtors, the typical down payment for first-time buyers has hovered between 6% and 9% since 2018. And depending on the type of loan, it could be even less:

So, whether you're a veteran or a first-time buyer, there are real options to make homeownership more attainable.

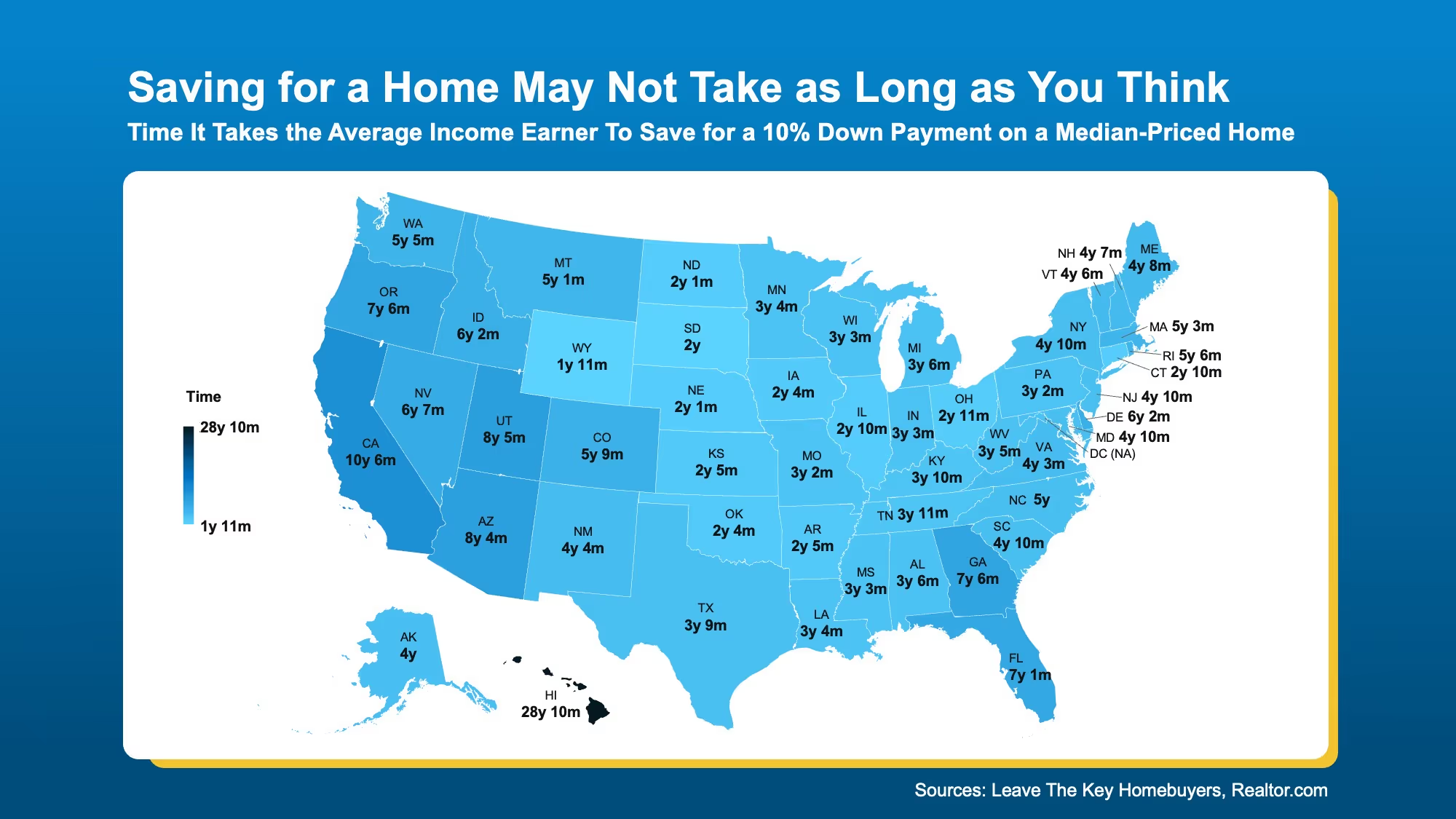

Saving takes time — but maybe not as much as you think. Your timeline depends heavily on where you live, your income, and how much you plan to put down.

A recent study calculated how many years it would take the average person to save for a 10% down payment in each state.

But remember, most buyers don’t need to put down a full 10%. And even better — some of that money may not need to come from your own savings.

This is one of the biggest misconceptions in real estate.

There are thousands of down payment assistance programs across the country — and nearly 4 in 10 people don’t even know they exist. These programs are built for people like you — buyers who are ready to own but could use a financial boost to get started.

Miki Adams, President of CBC Mortgage Agency, puts it simply:

“With high interest rates and soaring home prices, down payment assistance is more essential than ever.”

Don’t let down payment myths keep you stuck in renter mode. You may not need as much money as you think. And you certainly don’t need to navigate it alone.

Let’s talk. I’ll help you explore your options, connect you with resources, and create a plan to get you home sooner.

If a down payment wasn’t holding you back, would you be ready to start your home search?