If you are looking for a home in Hillsborough or Pinellas counties right now, you might feel stuck in a game of "wait and see." We hear it often from clients in Riverview and Brandon: "We’re waiting for rates to drop just a little bit more."

Specifically, many buyers are watching mortgage rates hover in the low 6% range and telling themselves they will buy once rates hit the 5% range. It sounds logical—who doesn't want a lower monthly payment? But here is the reality: waiting for that specific number might not save you as much as you think, and it could actually cost you more in the long run.

Affordability is still a hurdle; we know that. However, the market has already shifted in your favor. Mortgage rates have come down significantly from their peak earlier this year.

Let’s look at the numbers. Rates peaked in May around 7%. Since then, they have slowly declined and are now sitting in the low 6s. While that might not sound like a huge headline, it translates to real savings. On a typical $400,000 home, the monthly payment is already down nearly $400 compared to May. That is real money back in your pocket every month compared to buying just last spring.

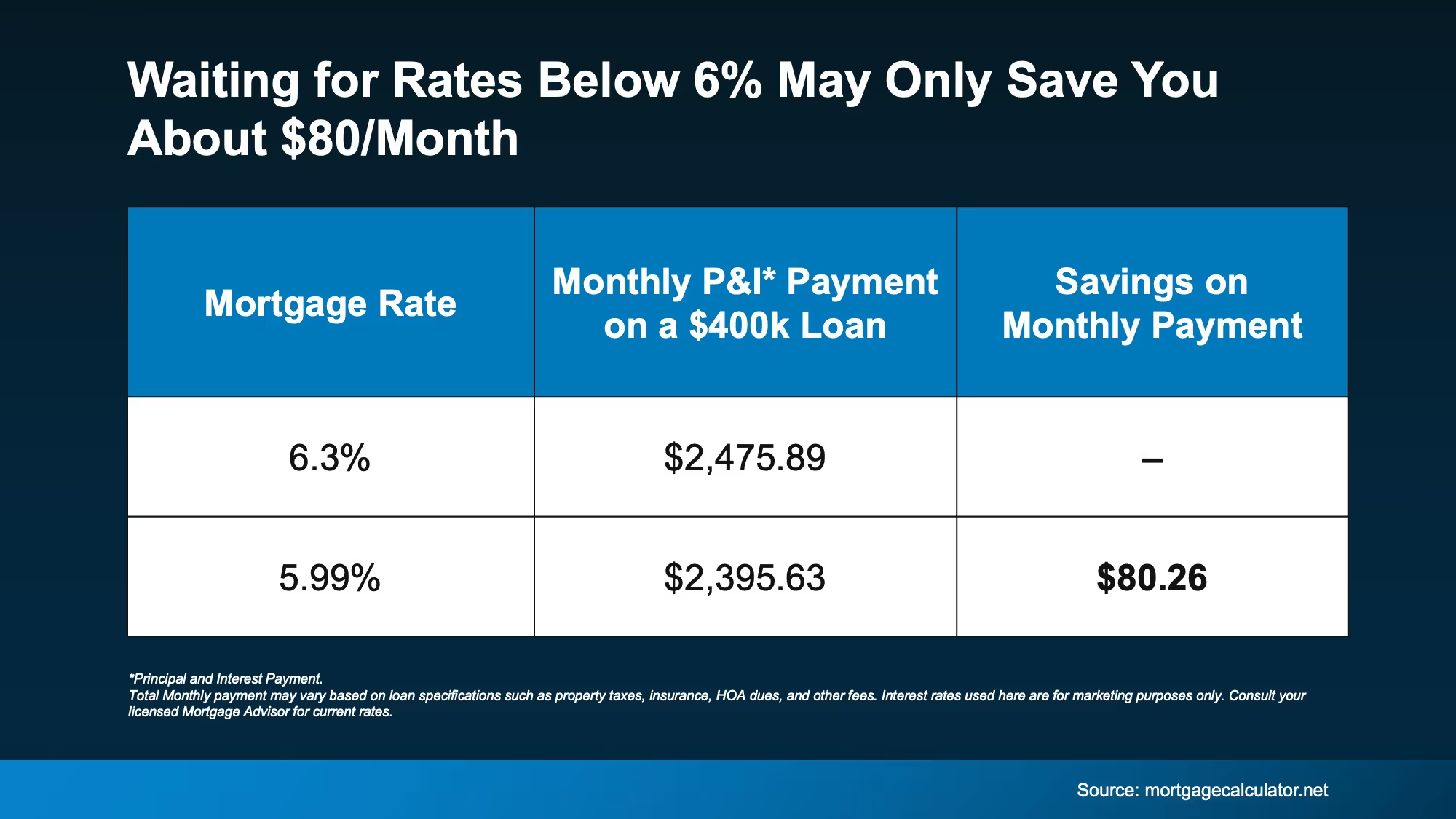

So, what if you wait for rates to drop even further? Let’s break it down.

If rates dip to 5.99% from where they are today, the difference in your monthly principal & interest payment on an average-priced home is only about $80.

Think about that—$80. That is roughly the cost of one nice dinner out in St. Petersburg or a family movie night. While every bit of savings counts, is it enough to put your life on hold?

Most experts agree that mortgage rates are likely to stay near their current levels throughout 2026. So, holding out for a massive drop might leave you renting for another year or two with no guarantee of significantly lower rates.

For rate-timing context, read New Construction Pace: Why Builders Are Tapping the Brakes.

Here is the factor most buyers overlook: competition.

Right now in the Greater Tampa Bay area, you have more homes to choose from and sellers who are willing to negotiate. You can often get concessions for closing costs or repairs.

But if rates drop below 6%, the psychology of the market shifts. The National Association of Realtors (NAR) estimates that if rates hit 6%, millions of additional households will regain purchasing power. Even if only a fraction of those buyers enter the market, competition will heat up instantly.

More competition means multiple offers, bidding wars, and higher home prices. That $80/month savings you waited for could be completely wiped out—and then some—by paying a higher purchase price for the house.

For inspection and timeline basics, watch How a Mortgage Works | Pre Approval to Closing Costs.

If you find a home you love in Valrico or Ruskin and the math makes sense for your budget today, getting ahead of the crowd is often the smartest financial move.