If you have seen headlines about foreclosures rising, it is easy to assume the market is headed for another crash. In Florida, especially across Tampa, Riverview, Brandon, Westchase, and St. Petersburg, that fear can make homeowners hesitate and buyers second guess their plans.

The better move is to separate scary headlines from what the numbers actually mean.

Foreclosure activity can rise for reasons that have nothing to do with a housing collapse. In a normal market, there are always some homeowners who face job changes, medical bills, divorce, or other financial stress. When that happens, a portion of loans will go delinquent and some will enter the foreclosure process.

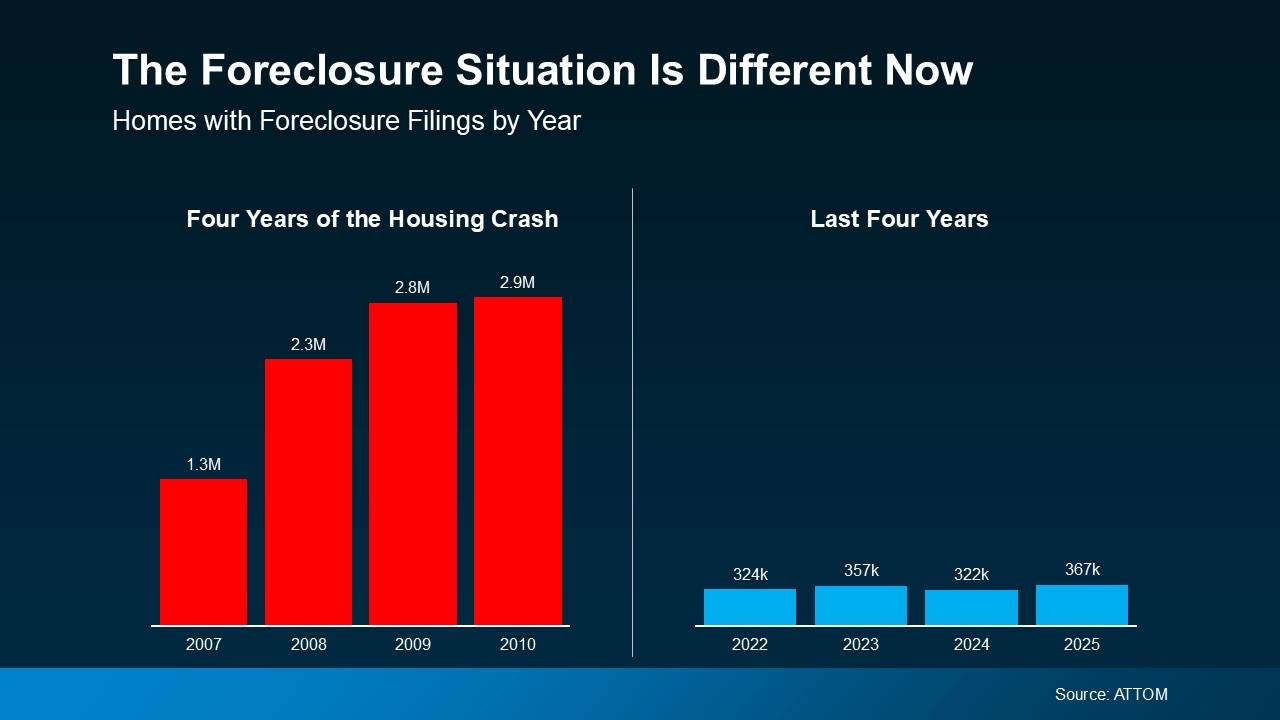

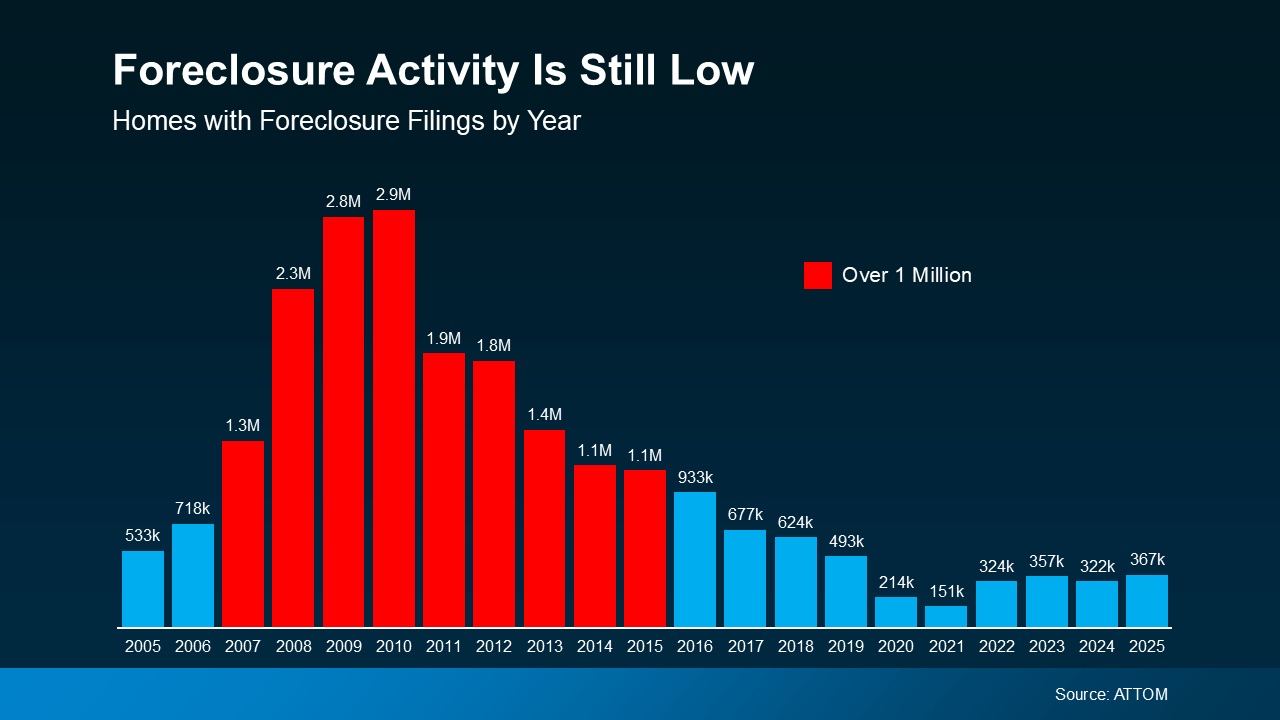

An increase can also happen after several years of unusually low foreclosure levels. When the baseline is extremely low, even a modest return toward normal can look dramatic in a headline.

The last crash was fueled by a mix of weak lending, risky loan products, and too much housing supply. Today, the ingredients are different, and that matters for Florida homeowners.

Here is what has changed:

Equity is the key difference. When a homeowner has equity, foreclosure is often the last option because selling may protect their credit and preserve cash they can use for their next move.

A year over year increase does not automatically mean distress is spreading across neighborhoods. What matters is whether foreclosures are returning to a typical range or moving toward crisis levels.

Even with an uptick, the bigger story is the distance between today and the peak crisis years.

If you own a home in the greater Tampa Bay area, a foreclosure wave is not something you should assume is coming. Most homeowners are not forced sellers, and most have options.

If you are feeling financial pressure, the best strategy is early action. In many cases, a planned sale is far better than waiting until choices narrow.